Wilcon Depot Releases Fourth Quarter and Full Year 2020 Results

Posted March 3, 2021, 4:34 pm

Wilcon Depot, the Philippines’ leading home improvement and finishing construction supplies retailer, announced today fourth quarter and full year 2020 results.

For the full year 2020, the COVID-19 pandemic and the consequent quarantine measures have greatly impacted the Company’s operations with net sales decreasing by 7.5% to ₱22.629 billion and net income declining by 31.8% to ₱1.449 billion. The Company in its BOD meeting on February 24, 2021 declared cash dividends of ₱0.12 per share representing regular and special dividends of ₱0.10 and ₱0.02 per share, respectively.

The Company remains committed to its growth plans despite the temporary setback and has in fact proceeded with the opening of new stores albeit two of the planned eight new stores for 2020 were pushed back to January 2021. Wilcon closed the year with 63 branches nationwide, achieving its IPO-commitment of a 65-strong store network in January 2021, still ahead of the original end-2021 schedule.

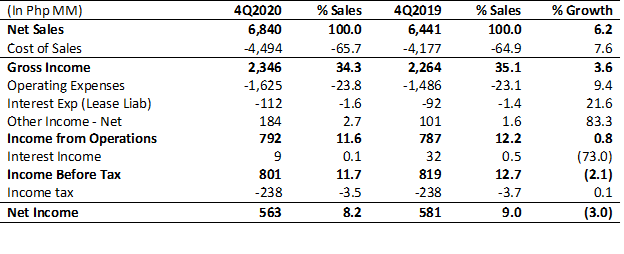

Fourth Quarter Results

Net sales for the fourth quarter totaled ₱6.840 billion, up 6.2% or ₱399 million year-on-year. The increase is attributed mainly to the contribution of new stores as comparable sales performance was flattish at negative 0.5%. Gross profit amounted to ₱2.346 billion, up 3.6% or ₱82 million year-on-year with a gross profit margin of 34.3%. Operating expenses was up 9.4% or ₱139 million to total ₱1.625 billion for the quarter due mainly to expansion-related expenses. Other income, on the other hand, jumped 45.4% or ₱60 million to ₱193 million in view of the full recognition of the rent concession obtained from lessors partly offset by the reduction in interest income and net other income/charges from trade and other suppliers. Net income for the quarter was down 3% or ₱18 million to close at ₱563 million traced mainly to the drop in interest income. Excluding interest income, earnings would have been slightly up by 1.1% or ₱6 million year-on-year.

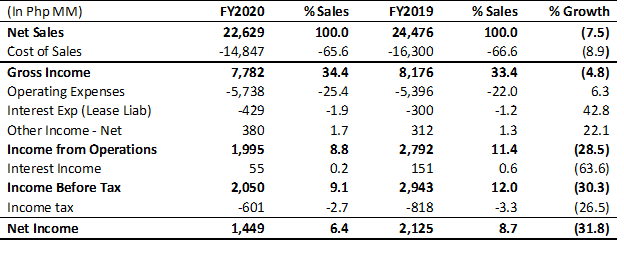

Full Year 2020 Results

For the full year 2020, net sales amounted to ₱22,629 billion, down 7.5% or ₱1.847 billion year-on-year with a comparable sales decline of 13.6%. The two-month closure of the company’s Luzon branches and the continuing stringent quarantine measures particularly in Metro Manila mainly drove the drop in comparable sales.

The depots, accounting for 97.0% or ₱21.941 billion of total net sales, grew by 6.5% or ₱1.528 billion from the ₱23.469 billion net sales generated in 2019 but with a negative same store sales growth of 12.9% for the year. Net sales generated by the smaller format, “Home Essentials” (HE) stores, comprising the 2.2% or ₱510 million of total net sales, likewise reported a drop of 22.4% or ₱148 million for the year since six out of the seven Home Essentials are located in Metro Manila. All HEs are in operation for more than a year. The remaining 0.8% was accounted for by the project sales or sales to major developers, amounting to ₱178 million, decreasing by 49.2% or ₱172 million owing to the suspension of and delays in the completion of ongoing projects of our institutional accounts. During the year, the Company opened six new depots, all located in Luzon bringing the total number of stores to 63 (56 depots and seven home essentials) by the end of 2020. Three stores each were opened in Southern Luzon and Northern Luzon.

Gross profit meanwhile dropped by 4.8% or ₱394 million to ₱7.782 billion in view of the lower sales. The gross profit rate increased by one percentage point to 34.4% as the contribution of the higher margin products increased to 50.9% from 49.5% for the same period.

Operating expenses, owing to the continued store network expansion efforts and pandemic-related expenses, particularly in depreciation and amortization and donations and contributions, respectively, still increased by 6.3% or ₱342 million year-on-year, to total ₱5.738 billion in 2020. These increases were partly offset by the decreases in utilities, trucking and advertising. Interest expense representing non-cash interest charged on lease liabilities amounted to ₱429 million, up ₱129 million year-on-year.

Other income (charges) amounted to ₱435 million, down 5.9% or ₱27 million year-on-year due mainly to the decline in interest income and net other income from trade and other suppliers partly offset by the full recognition of lease concessions obtained from the company’s various lessors. Excluding interest income and one-time lease concession, other income from operations declined by 10.3% or ₱32 million year-on-year to ₱279 million from ₱311 million in 2019.

Income tax expense at ₱601 million, in view of the lower taxable income, likewise was lower by 26.5% or ₱217 million. Net income for the year fell 31.8% or P676 million to ₱1.449 billion from the ₱2.125 billion reported in 2019.

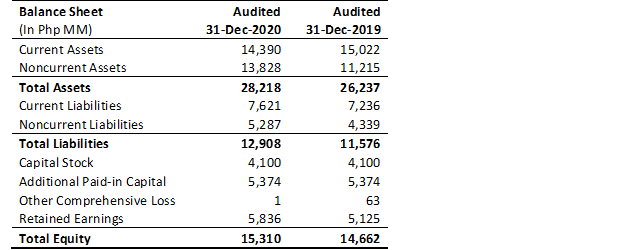

Capital expenditure for 2020 totaled ₱2.503 billion. The bulk (68.0%) was spent on new stores, while the remainder was spent on warehouses, extensions and renovations (24.4%), and furniture, equipment, and IT Software (7.6%).

According to Wilcon’s President and CEO, Ms. Lorraine Belo-Cincochan, the Company will continue with its expansion plans and will open nine new stores in 2021. Two were opened in January 2021 with seven more to be opened for the year. The company budgeted ₱3.2 billion for its planned capital expenditure for the year which includes the new stores and warehouses, renovations and extensions among others.