WILCON REPORTS ₱328 MILLION NET INCOME FOR 1Q2020

Posted May 12, 2020, 1:49 pm

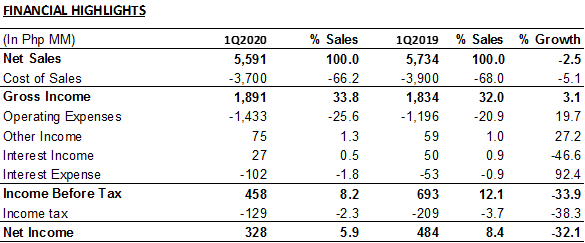

- Net sales of ₱5.591 billion, down 2.5% year-on-year

- Gross income of ₱1.891 billion, up 3.1% year-on-year for a GPM of 33.8%

- Net income of ₱328 million, dropped by 32.1% year-on-year

Wilcon Depot, Inc.’s (WiIcon/the Company) President and CEO, Lorraine Belo-Cincochan, today announced the Company’s first quarter 2020 results.

“Wilcon Depot was not spared from closure when the Enhanced Community Quarantine (ECQ) was imposed by the Philippine government over Luzon on March 17, 2020. Under the ECQ, our line of business was excluded from the “essentials” category. We closed all our 44 branches, which accounted for 84% of our net sales in 2020 pre-ECQ. As a result, our net sales declined by 2.5% or P143 million to P5.591 billion for the first quarter of 2020 from last year’s P5.734 billion. It was unfortunate that we had to close because we were doing so well pre-ECQ but of course the well-being and health of everyone are paramount.” Ms. Belo-Cincochan said.

The Company recorded a 32.1% or ₱155 million drop in net income to ₱328 million for the first quarter of 2020, from the ₱484 million reported during the same period in 2019. Gross profit, on the other hand still modestly grew by 3.1% or P57 million to P1.891 billion despite the net sales contraction due mainly to the increase in the contribution of the higher-margin exclusive and in-house products to total net sales to 50.9% during the period versus 48.8% in the first quarter of 2019. Gross profit margin stood at 33.8% for the quarter.

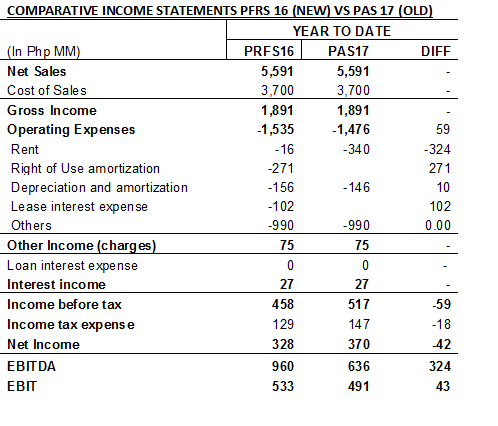

The main factor that pushed net income downward was the increase in operating expenses year-on-year. Operating expenses rose 19.7% or P236 million to P1.433 billion for the period, traced mainly to the increase in lease and manpower related expenses. The Company adopted the new accounting standard for leases, PFRS/IFRS 16 in 2019 on a staggered basis – adopting the PFRS16 on leases with term balances of less than one year only upon renewal. Majority of the leases were renewed and converted to IFRS/PFRS 16 standard on June 1, 2019. Total actual rent due (including non-PFRS/IFRS 16 leases) for the first quarter totaled P284 million, while lease-related expenses recognized under rent, depreciation and amortization and interest expense amounted to P390 million.

Also, Wilcon’s adjustment across-the-board of the salaries of all employees effective April 1, 2019 plus the hiring and promotion of personnel for its new branches drove upwards operating costs year-on-year.

Net other income, which includes rent income and billings to and from merchandise and other suppliers and from customers, increased by 27.2% or P16 million to P75 million in view of the increased volume of business pre-ECQ. Interest income meanwhile decreased by 46.6% to P27 million year-on-year as investible funds were continuously being deployed for expansion purposes and dividend distribution.

Ms. Belo-Cincochan added, “Our comparable sales growth for the quarter was negative 8.0% since out of 52 stores aged one year and above, 40 of which are in Luzon. Pre-CQ/ECQ, January 1 to March 13, 2020 (announcement of Community Quarantine) comparable sales growth was at 10.7%, with February growth at 14.1% and March 1-13 growth at 9.3%.

Depots recorded P5.375 billion in net sales comprising 96.1% of the total and receding by 2.4% or P133 million year-on-year. Same store sales growth (sssg) for depots was negative 8.1%. Pre-CQ/ECQ, sssg of depots reached 10.3%. Our Home Essentials’ net sales, accounting for 2.5% of the total, likewise dropped by 14.8% or P24 million to P137 million since six out of seven stores are in Metro Manila. Pre-CQ/ECQ growth was at 5.2%. All Home Essentials branches are over one year old. Project sales, meanwhile, grew by 21.1% to P79 million, accounting for the remaining 1.4% of total net sales. We were able to open one new depot in the province of Albay which is also located in Luzon, which brought our total number of stores to 58.

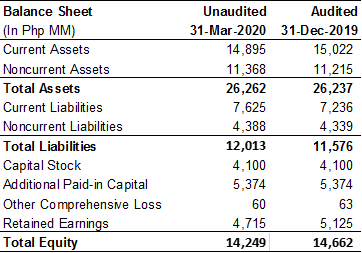

We ended the first quarter with a fairly strong financial position, given the circumstances. We are still bank debt-free with cash and placements totaling P3.932 billion at the close of the quarter. Our inventory level inched up to P9.633 billion from the 2019 yearend balance of P9.518 billion. Our fresh imports ordered beforehand started coming in mid-March.

Our store network expansion target for the year will be cut down to maximum of six from the original eight to nine. These stores were already in various stages of construction when the ECQ was announced. We should be able to hit our 65-store target by the first half of 2021. The long-term target of 100 stores remain unchanged.

Our earlier announced guidance of mid-teens growth for both the topline and the bottomline is now highly unlikely. What we are expecting though is a relatively faster recovery when mobility restrictions are lifted with pent-up demand from unfinished construction projects and new demand from the renovation, repair and maintenance market given the wear-and-tear of homes and household items during ECQ and new sanitation and health standards of the new normal.”