WILCON POSTS ₱2.125 BILLION NET INCOME FOR FY2019

Posted March 2, 2020, 10:11 am

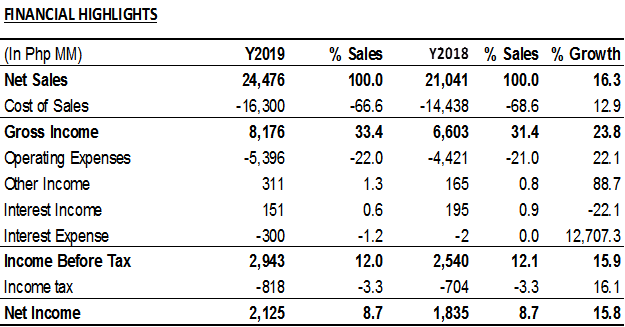

- Net sales of ₱24.476 billion, up 16.3% year-on-year

- Gross income of ₱8.176 billion, up 23.8% over 2018 for a GPM of 33.4%

- Net income of ₱2.125 billion, grew 15.8%; EPS at ₱0.52 per share

“We are pleased with our full year 2019 results and it was another strong one for us with our net income growing 15.8% to ₱2.125 billion from 2018 post changes in accounting policies and standards. Coming off a high base, we had a respectable topline growth and the margin improvement we gained from our product mix strategy cushioned the spike in our operating expenses as we had planned. These results certainly will encourage us more to continue in our strategic direction and give us assurance that we can deliver consistent growth in the coming years,” said Lorraine Belo-Cincochan, Wilcon Depot’s President and CEO. She added, “because of this strong showing and our expectation based on results that we will be able to maintain our growth trajectory, our board of directors approved a regular dividend of ₱0.12 per share and a special dividend of ₱0.06 for a total cash dividend of ₱0.18 per share. This represents a 12.5% increase over 2019’s dividend payout of ₱0.16 per share.”

Net sales grew 16.3% or ₱3.435 billion year-on-year to total ₱24.476 billion for 2019 at the back of a steady ramp up of the new stores which contributed ₱2.331 billion or 67.9% of the total increase and comparable sales growth of 5.2% for the full year. Six (6) new depots were opened during the period, increasing the branch tally to 57 at the close of 2019.

The depots comprised 95.9% of net sales totaling ₱23.469 billion generated from 50 branches. Depot sales rose by 16.5% or ₱3.318 billion with a same store sales growth of 5.0%. Sales from the smaller format, Home Essentials, accounted for 2.7% or ₱658 million of net sales, growing by 6.2% in total with a same store sales growth of 4.0%. There are seven (7) Home Essentials branches at the close of the year and there are no immediate plans to expand this format. Project sales, meanwhile accounted for the remaining 1.4% or ₱349 million, growing 28.6% or ₱78 million year-on-year.

Wilcon’s effective implementation of its product mix strategy continued to drive margin expansion. Exclusives’ (in-house and exclusive brands) contribution to net sales increased to 49.5% for the year driving the expansion in the blended gross profit margin to 33.4%. Gross profit amounted to ₱8.176 billion, up 23.8% or ₱1.573 billion year-on-year. Volume and cash discounts from non-exclusive suppliers also increased as sales of non-exclusive products likewise continued to grow.

Operating expenses in 2019, including re-classified rent expense to interest expense, recorded the highest increase year-on-year in the last three years traced mainly to changes in accounting policies and standards, expansion-related expenses and re-alignment of salaries following the new statutory wage adjustment in 4Q2018. Operating expenses amounted to ₱5.396 billion, up 22.1% or ₱975 million year-on-year; and including re-classified rent expense to interest expense, would total ₱5.696 billion, an increase of 28.9% or ₱1.275 billion over the prior year’s balance.

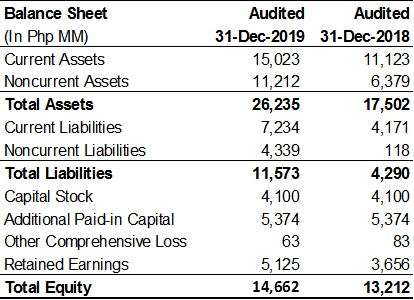

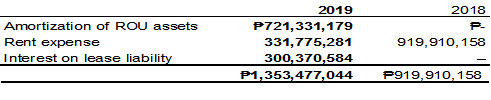

The company adopted the new accounting standard for leases, Philippine Financial Reporting Standard 16 (PFRS 16) starting January 1, 2019, which involved the recognition of the company’s qualified operating leases as right-of-use assets with the corresponding lease liabilities in the balance sheet. As a result, qualified lease-related expenses previously classified as rent expense are reflected in the income statement as depreciation/amortization of the right-of-use assets and interest expense on the lease liabilities.

Details of lease expense are as follow:

Total actual rental payments in 2019 amounted to ₱1.188 billion including rent of transport and other equipment and leases exempted from the adoption of PFRS 16.

Other income (including rent income and excluding interest income) from trade and non-trade suppliers and non-merchandise sales related income continued to grow as Wilcon’s store network expands. Rent and other income rose to ₱311 million in 2019, increasing by 88.7% or ₱146 million from the previous year’s level. Interest income from placements meanwhile declined by 22.1% or ₱43 million to ₱151 million at the close of 2019 as investible funds were being deployed for the construction of new stores, extensions and warehouses; and excess cash were paid out as dividends.

Wilcon closed 2019 with a net income of ₱2.125 billion, a 15.8% or ₱289 million growth over the previous year’s net earnings, post-PFRS 16. Pre-PFRS 16 changes, net income would have been ₱2.225 billion, equivalent to a 21.2% or ₱389 million growth.

In closing Ms. Belo-Cincochan said, “our capital expenditure for 2019 reached ₱2.649 billion comprised mainly of construction of new stores, warehouses and extensions to or renovation of existing stores and investment in computer software, among others. We are on track to finish 2020 with at least 65 stores as we are set to open between eight to nine depots this year. For 2020, we have budgeted around ₱2.9 billion in capital expenditures to fund the construction of new stores, more renovations and extensions as we are upgrading some old branches for these to be at par with our new stores and others. We are targeting to maintain a mid-teen topline and net income growth for 2020 as well as a steady five to six percent (5% – 6%) comparable sales growth.”