WILCON DEPOT REPORTS P1.544 BILLION 9M2019 NET INCOME

Posted November 8, 2019, 10:49 am

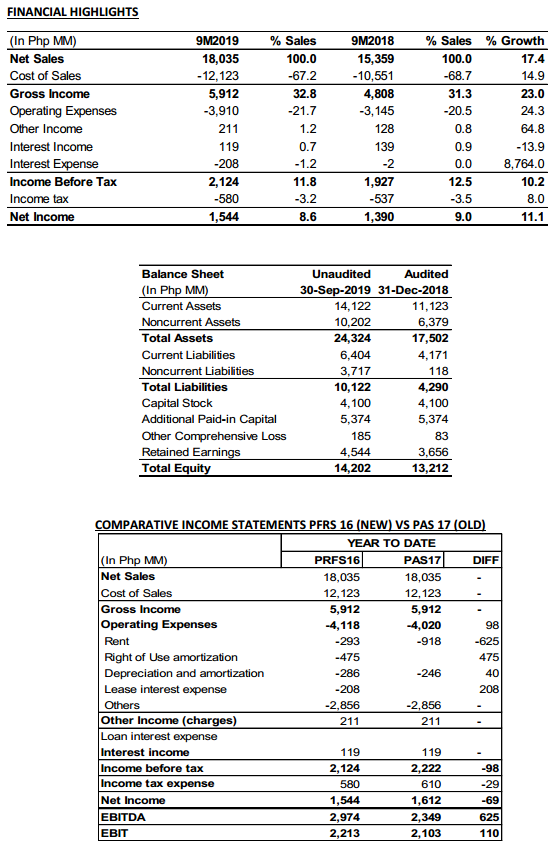

- Net sales up 17.4% to ₱18 billion with a comparable sales growth of 5.4%

- Gross profit margin increased to 32.8% from 31.3% in 9M2018

- Net income grew 11.1% y-o-y to ₱1.544 billion for a net margin of 8.6%

Wilcon Depot, Inc. (PSE:WLCON), the Philippines’ largest home improvement and finishing construction supplies retailer reported net income of ₱549 million in the third quarter, up 15.5% or ₱74 million year-on-year. This increased its net income tally for the year to ₱1.544 billion, 11.1% or ₱154 million higher than the 2018 nine months total. The increase was driven mainly by the sustained margin expansion due to the improving sales mix in favor of higher margin products and the growth in net sales.

Net sales grew 17.4% or ₱2.676 billion from the prior year’s nine months total of ₱15.359 billion to this year’s ₱18.035 billion. Comparable sales growth improved to 5.4% from the first half 2019 growth of 4.7% while new stores’ sales of ₱1,849 million contributed the balance of the total growth. Comparable sales growth improved to 6.6% quarter-on-quarter.

The depot format stores accounted for 95.8% of total net sales reaching ₱17.284 billion for the nine- month period, up 17.7% or ₱2.602 billion with a same store sales growth of 5.2%. Three new depots were added in the third quarter, bringing to 48 the total number of depots and 55 stores overall by the end of the quarter. Same store sales growth of the depots for the quarter improved to 6.5% from the previous quarter’s 1.4%.

The smaller format Home Essentials contributed 2.7% or ₱492 million for the period, up 6.4% or ₱29 million from the same period in 2018 with a same store sales growth of 3.4%. All but one of the Home Essentials branches are located in Metro Manila and are some of the Company’s oldest stores. No new branches were opened during the year. Project sales or sales to large property developers and to the hospitality industry grew 20.6% to total ₱260 million for the year. Project sales accounted for 1.4% of the Company’s net sales.

Gross profit margins maintained its growth in view of the increasing contribution of the higher-margin exclusive and in-house brands which now account for 49.2% of net sales and from the improving margins of non-exclusive products as sales volume continued to rise and cash payment discounts are availed. Gross profit for the period amounted to ₱5.912 billion, up 23.0% or ₱1,104 billion from last year’s ₱4.808 billion. Gross profit rate increased to 32.8% for the nine-month period this year versus last year’s 31.3% during the same period.

Operating expenses meanwhile continued to rise as new stores continue to be opened and the adoption of the new accounting standard for leases starting this year. Operating expenses totaled ₱3.910 billion, increasing by 24.3% or ₱765 million from the same period last year of ₱3.145 billion. Including the portion of rent expense re-classified to interest expense, total operating expenses amounted to ₱4.118 billion for the three-quarter period. Other than depreciation and amortization, other significant increases were in manpower expenses, utilities, trucking and taxes and licenses.

For the three-quarter period, depreciation expense attributed to the right-of-use asset totaled ₱475 million while lease interest expense amounted to ₱208 million for a total re-classified lease-related expense of ₱683 million. Including leases excluded from PFRS 16, total rent expense amounted to ₱976 million. Actual cash lease payments due for the period totaled ₱848 million. Total impact of the adoption of PFRS 16 to net income (versus the previous accounting standard, PAS 17) including the downward adjustment of the useful life of store buildings is ₱69 million, net of tax.

Other income amounted to ₱211 million for the period, 64.8% or ₱83 million higher than the same period last year of ₱128 million. Expanding store network and increasing sales volume provided more opportunities for non-merchandise sales related income and supplier rebates. Interest income of ₱119 million meanwhile continued to drop due to the continuing deployment of the IPO proceeds for expansion and the increased dividend amount distributed during the year.

Capital expenditure for the three-quarter period reached ₱2.029 billion, mainly for the construction of new stores, warehouses and extensions or renovations of a few existing stores.

Wilcon’s President and CEO, Lorraine Belo-Cincochan said, “We are pleased with our performance in the third quarter. Our gross profit margin continued to improve and comparable sales growth rate increased from 1.9% to 6.6% quarter-on-quarter, which partly offset the impact of our increasing operating expenses attendant to our store network expansion. Hence, we were able to register a 15.5% net earnings growth for the third quarter.”