Wilcon Depot Reports First Quarter 2019 Results

Posted May 16, 2019, 5:24 pm

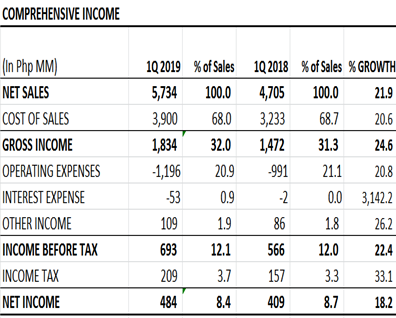

- Net income grew 18.2% y-o-y to ₱484 million for a net margin of 8.4%

- Net sales increased 21.9% y-o-y to ₱5.734 billion with a comparable sales growth of 7.9%

- Gross profit margin improved to 32.0% from 31.3% in 1Q18 as gross profit rose 24.6% y-o-y

- Yearly cash dividends increased by 45.4% to ₱0.16 per share

Wilcon Depot, Inc. (PSE:WLCON), the Philippines’ leading home improvement and finishing construction supplies retailer reported net income of ₱484 million for the first quarter of 2019, 18.2% or ₱74 million higher than the ₱409 million earned during the same period in 2018. The increase is attributed mainly to a strong net sales growth and healthy gross profit margin expansion.

Total net sales grew by 21.9% or ₱1.029 billion year-on-year to ₱5.734 billion for the period, at the back of a 7.9% comparable sales growth and a solid contribution from new stores which accounted for the remaining 14% of the total topline growth of 21.9%. Sales from depot format stores, accounted for 96.1% of total net sales, growing by 22.5% versus the same period last year, driven by same store sales growth of 8.0% and contribution from new stores. For the period, Wilcon opened one depot in Davao, its second branch in the city. The smaller format Home Essentials’ sales likewise grew by 9.7% to close at ₱161 million with a same store sales growth of 4.5% for the period. Sales from the format accounted for 2.8% of total net sales. The remaining 1.1% of total net sales is accounted for by project sales (sales to large property developers), totaling ₱65 million for the period, a 4.9% increase year-on-year.

Gross profit reached ₱1.834 billion, up 24.6% or ₱362 million year-on-year for a gross profit margin of 32.0% in view of higher sales particularly of the higher-margin exclusive and in-house brands. Contribution to net sales from exclusive and in-house brands improved to 48.8% of total net sales, exceeding the target contribution for the year of 48.0%.

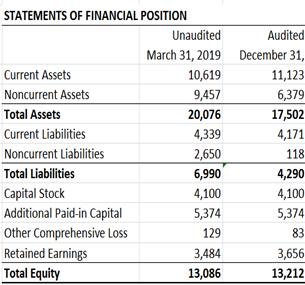

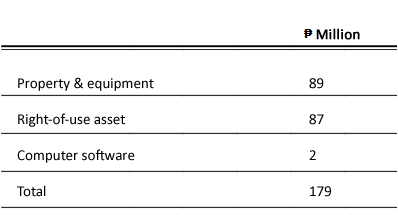

Operating expenses rose 20.8% to ₱1.196 billion versus the same period last year largely due to increases in depreciation and amortization, manpower costs and utilities. Depreciation and amortization recorded the highest increase at 487.0% or ₱148 million to amount to ₱179 million for the period as a result of the continuous addition of company-owned store buildings and the re-classification of part of rent expense to depreciation. In view of the adoption of PFRS 16 by the Company effective January 1, 2019, changes in the recognition of operating leases resulted in the distribution of part of the rent expense into depreciation and interest expense. Operating leases expiring within 12 months were treated as short- term leases and the straight-line rent expense recognition was maintained. Additionally, Wilcon changed its accounting estimate on the useful life of its store buildings from 20 to 15 years to align with the lease term of the land. Hence, while depreciation and amortization increased, rent expense dropped by 31.7% or ₱67 million year-on-year to close at ₱144 million at the end of the quarter. Depreciation and amortization expense are broken down as follows:

Interest expense for the quarter ballooned to ₱53 million, attributed wholly to the non-cash interest charges on the lease liability.

In total, the shift to PFRS 16, including the change in the accounting estimate for depreciation of store buildings, resulted in a decrease in Wilcon’s first quarter net income by ₱25 million.

Rent and net other income from merchandise and other suppliers amounted to ₱59 million for the period, up 40.8% or ₱17 million year-on-year due to the increased volume of business. Interest income also increased by 12.4% to amount to ₱50 million at the close of the first quarter.

Wilcon, for the second straight year, declared cash dividends, increasing by 45.4% to ₱0.16 per share from last year’s ₱0.11 per share.

The Company have expended ₱750 million on capex in the first quarter in its continued expansion. For the rest of the year, Wilcon is set to open six to seven more depots scattered all over the country, after the two opened so far this year. Six of the existing branches are also being expanded along with the distribution centers in support of the expanding store network.

Seeing that the Company was able to exceed its target contribution to total net sales of its in-house and exclusive brands at 48.8%, management is aiming for a minimum 49% contribution for the year. This is to be able to partly mitigate the impact of changes in accounting standards and policies on net earnings.